What’s ahead for Central London’s office market in 2026? (Q1 2026 updated)

The Central London office market enters 2026 in a more stable position than many expected at the start of the year. Vacancy has stopped rising, demand has become more decisive, and pricing power has shifted firmly toward high-quality space. For landlords and occupiers, the market is no longer defined by uncertainty, but by selectivity and timing.

Below is an updated market report and forward view based strictly on the latest December 2025 and Q1 2026 data from Savills, Cushman and Wakefield, CBRE, BNP Paribas Real Estate, and CoStar.

The current picture of the Central London office market

By December 2025, the Central London office market shows clear signs of adjustment rather than decline. Headline availability remains elevated, but the direction of travel has changed.

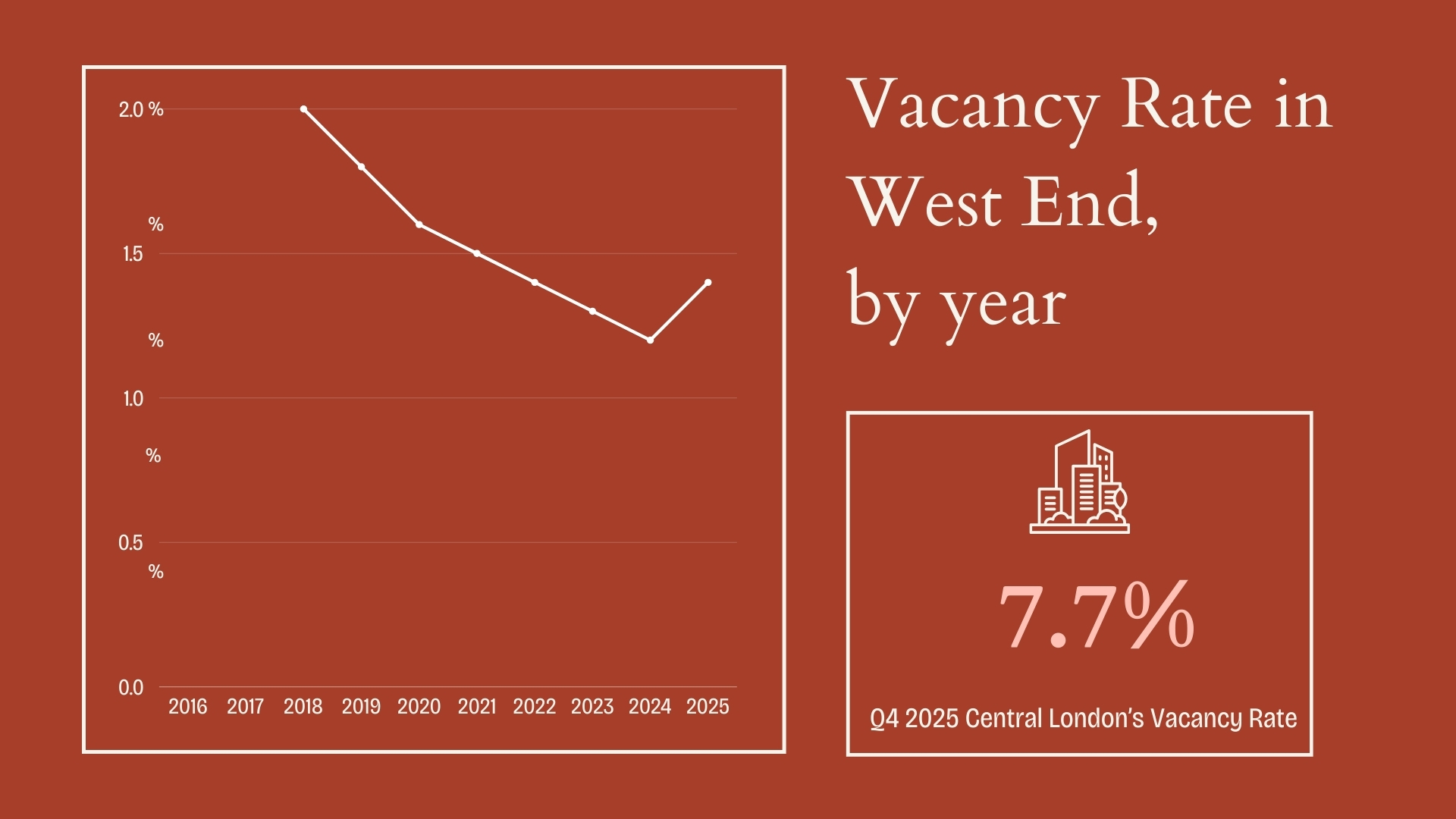

Vacancy has stabilised at approximately 7.7 percent, holding steady since October. This marks a sharp improvement from the early 2025 peak of around 10.6 percent. The shift reflects improving absorption, especially within higher specification buildings, while tenant controlled supply remains close to decade lows despite a modest month on month increase.

Leasing activity has also proven resilient. Year to date take up reached around 7.6 million square feet by November, broadly in line with five year averages, although still around 12 percent below the same point last year. Monthly volumes remain uneven, with November recording just under 500000 square feet, yet the wider pipeline tells a more positive story. Active requirements stand at approximately 13.2 million square feet, with 2.7 million square feet already under offer, supporting momentum into year end and early 2026.

For both landlords and tenants, this signals a market that has found its footing, but one that rewards quality and decisiveness.

A polarised market driven by quality rather than volume

Headline availability remains elevated, but vacancy figures alone no longer reflect market health. Total availability stood at around 27.79 million square feet by the third quarter , well above long term averages. However, this stock is heavily weighted toward secondary and older buildings. In contrast, demand continues to concentrate on modern offices, with around 70 percent of Q3 take up attributed to Grade A space.

This divergence is evident across submarkets. The City recorded its strongest demand levels in over a decade, supported by large requirements and pre-lets. The West End experienced quieter take up in certain months, yet continued to command record pricing where high quality, well located buildings were available. The result is a market where risk and opportunity are increasingly asset specific rather than location wide.

Source: Savills UK

High quality space continues to command pricing power

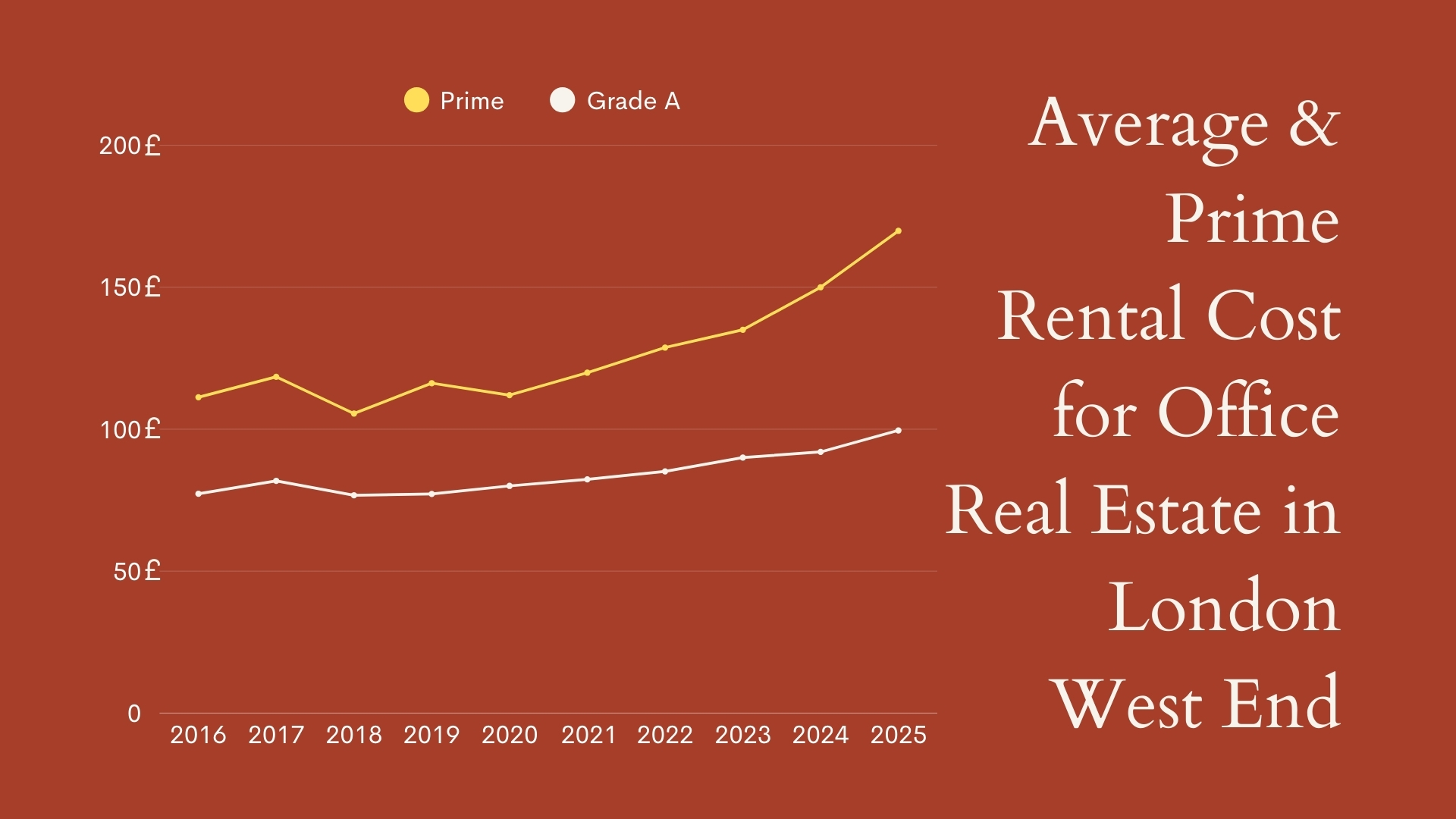

Rental performance in the second half of 2025 confirms the strength of demand for best in class offices. Prime rents reached new record levels during the year, highlighted by a £240 per square foot transaction in the West End. In the City, prime rents averaged approximately £99.75 per square foot by the end of the third quarter, reflecting steady quarterly growth.

For 2025 as a whole, prime rental growth is estimated at around 4.0 percent in the West End and 5.5 percent in the City. This growth has been driven by limited supply and early occupier commitment rather than short term market sentiment.

Looking ahead, forecasts indicate average annual rental growth of around 3.9 percent in the City from 2026 to 2029, supported by a constrained development pipeline and sustained competition for premium space.

Source: RNS

Supply constraints reshape occupier behaviour

Development activity remains insufficient to meet demand for high quality offices. Space under construction totals approximately 14.16 million square feet, with around 35 percent already pre let. For larger schemes scheduled between 2026 and 2029, early commitments further reduce future choice, particularly for occupiers seeking scale in core locations.

This shortage is already influencing behaviour. In 2025, occupiers requiring more than 100,000 square feet committed to new space an average of just over four years ahead of lease expiry, compared with less than three years in 2022. Early decision making has become a response to limited availability rather than expansionary confidence.

Flexible workspace has continued to grow, now accounting for around 10 percent of total Central London office stock, up from 6 percent before the pandemic. This reflects a structural shift toward adaptability rather than reduced demand for offices.

Key trends of the office market to watch for in 2026

Demand continues to focus on high quality office space

The concentration of demand in high-quality office space has become more pronounced rather than easing. By late 2025, around 70 percent of quarterly take up was captured by Grade A offices, despite overall availability remaining elevated at close to 27.8 million square feet. This reflects a market where occupiers are willing to delay decisions or commit early in order to secure space that meets location, sustainability, and workplace expectations.

As a result, secondary offices continue to experience weaker absorption, even as headline vacancy rates stabilise. The gap in leasing performance between modern, well located buildings and older stock is expected to widen further into 2026.

Limited supply is pushing occupiers to commit earlier

Limited future supply is now directly shaping occupier behaviour. With around 35 percent of space under construction already pre-let, and a restricted pipeline of new Grade A completions beyond 2025, choice is narrowing for occupiers seeking large, future ready offices. This has led to a clear shift in decision making.

In 2025, occupiers requiring more than 100,000 square feet committed to new space an average of just over four years ahead of lease expiry, compared with under three years in 2022. Early commitment has become a response to limited availability rather than an indicator of expansionary demand.

Rental growth is concentrated in prime buildings

Rental performance entering 2026 remains selective and closely linked to asset quality. Prime rents reached new benchmarks during 2025, including £240 per square foot in the West End, while City prime rents approached £100 per square foot by the end of the third quarter. Full year growth of around 4.0 percent in the West End and 5.5 percent in the City was driven by competition for limited suitable stock rather than a broad based uplift in demand.

Secondary buildings have not experienced the same pricing momentum, reinforcing a two speed rental market that is likely to persist into 2026.

Sustainability is now essential to secure tenants

Sustainability considerations have moved beyond preference and into leasing reality. In 2025, both leasing demand and investment activity consistently favoured buildings with credible environmental strategies. Regulatory requirements, lender scrutiny, and occupier expectations are increasingly aligned, leaving limited tolerance for assets without a clear improvement pathway.

Buildings that fall short of energy and sustainability standards face rising friction in leasing, longer void periods, and weaker investor interest. As a result, sustainability is now a prerequisite for competitiveness rather than a value enhancing feature.

Flexible workspace supports occupier flexibility

Flexible workspace has settled into a defined role within the Central London office market. By late 2025, flexible offices accounted for around 10 percent of total stock, up from 6 percent in 2019. This growth reflects occupier demand for adaptability within longer term occupational strategies, particularly across professional and financial services.

Rather than displacing conventional offices, flexible space is increasingly used to manage growth, uncertainty, and portfolio risk alongside longer leases. This structural role is expected to remain stable into 2026.

Investment activity favours assets with strong leasing demand

Investment conditions entering 2026 are more supportive, but capital remains selective. By the third quarter of 2025, investment volumes reached approximately £6.4 billion, representing a 26 percent increase year on year. Prime yields stabilised at around 5.75 percent, improving pricing confidence and encouraging renewed activity.

However, investor focus remains firmly on assets with strong leasing performance, income visibility, and clear repositioning potential. Buildings that struggle to attract occupier demand are unlikely to benefit from the same recovery in liquidity.

You might be interested in 9 smart ways to build sustainable office designs (3)

Read more: Fitzrovia’s office rental price trends 2025: comparison with Mayfair & Soho (4)

Looking for office space that aligns with 2026 market demands?

Securing the right office in Central London can feel challenging, with shifting occupier needs, rising rents, and growing ESG requirements.

The Langham Estate, in the heart of Fitzrovia, provides a choice of blank canvas, fitted, and serviced offices as well as retail spaces. These are flexible solutions designed to help businesses adapt with ease. With a clear focus on sustainability and future-ready design, we create workplaces that support both practical requirements and long-term goals.

Find out how Fitzrovia can support your business – get in touch with The Langham Estate team today.

Securing the right office in Central London can feel challenging, with shifting occupier needs, rising rents, and growing ESG requirements.

The Langham Estate, in the heart of Fitzrovia, provides a choice of blank canvas, fitted, and serviced offices as well as retail spaces. These are flexible solutions designed to help businesses adapt with ease. With a clear focus on sustainability and future-ready design, we create workplaces that support both practical requirements and long-term goals.

Find out how Fitzrovia can support your business – get in touch with The Langham Estate team today.

In this article:

(1) Listed buildings in Central London & why office tenants should care?

(2) What does a flexible office look like?

(3) How to design a hybrid office that works for everyone

(4) 9 smart ways to build sustainable office designs

(5) Fitzrovia’s office rental price trends 2025: comparison with Mayfair & Soho